In previous contributions, we have taken a look at Article 5 (permanent establishment) and Article 10 (dividends) of the new Treaty for the Prevention of Double Taxation between Belgium and the Netherlands, which was signed on 21 June 2023.

This article deals with a number of important changes to the treaty article concerning the management of companies. The current Article 16 on directors appears in modified form as Article 15 in the new treaty.

Current situation

Under the current treaty, the income of a director or person holding a similar position is taxed in the country where the company is established. This means that a Belgian director of a Dutch BV pays income tax in the Netherlands, regardless of where the director actually does the work. This applies not just to the director’s remuneration purely for his/her formal office, but also to remuneration for managerial duties such as day-to-day management.

New treaty

In the new treaty things are different. The rule just mentioned only applies to remuneration received in the capacity of board member at a company. In other words, only the remuneration for the formal directorship is taxed in the country where the company is established. Other activities such as day-to-day management are taxed in accordance with Article 14 of the new treaty, on regular employees. This may make the taxation of a director-employee far more complex, as the employee’s physical presence in the country of residence and work is an important consideration in the article on regular employees.

Example – new treaty

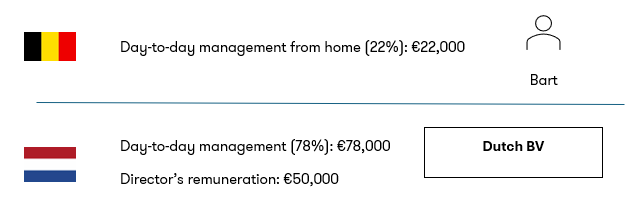

Bart lives in Belgium and has been appointed as director under the articles of association of a Dutch BV. He receives a director’s remuneration of €50,000. In addition, he receives a salary of €100,000 for day-to-day management activities; he performs 22% of these day-to-day management activities in Belgium.

One new point is that under the new treaty, Belgium can tax the income (€22,000) from day-to-day management activities performed in Belgium. The Netherlands taxes the director’s remuneration regardless of where the director works. The Netherlands can also charge tax on day-to-day management work carried out in the Netherlands.

Given this, it is important to make a clear distinction in the director’s contract between remuneration for the formal directorship role as defined in the articles of association and remuneration for other activities such as day-to-day management.

Clearly, taxation of directors’ remuneration is becoming more complex: remuneration that is currently taxed exclusively in the Netherlands or Belgium may in future be partially taxed in the other country. In other words, there will be a salary split or payroll split, with the director paying taxes for these ‘other activities’ in different countries. In practice, this may be beneficial, as the lowest tax bracket can be used in two (or more) countries.

The director must include his/her worldwide income in the tax return in the country where he/she is resident. The director must therefore also include in this tax return remuneration that is taxed in the country where the BV is established. However, under the terms of the treaty, this income will not be taxed a second time.

Example

Bart has to include the following in his Belgian personal income tax return:

- remuneration for day-to-day management carried out in Belgium (€22,000)

- remuneration for a directorship (€50,000), and

- remuneration for day-to-day management carried out in the Netherlands (€78,000), which has been taxed in the Netherlands (after deduction of Dutch taxes and social security contributions)

In order to prevent double taxation, the income under points 2. and 3. is exempt from Belgian taxation (in accordance with the so-called exemption method). The reservation as to progressive tax rates applies here. This means that no Belgian income tax is paid on the Dutch income, but the Dutch income does count towards determining the applicable tax rate on the income taxable in Belgium. Municipal taxes are due, however.

If we take the reverse situation (Bart, a Dutch resident, is appointed to a Belgian BV and carries out 22% of the day-to-day management from the Netherlands), the Netherlands will also refrain from double taxation. The exemption method applies to the Belgian remuneration of €78,000 for day-to-day management.

Before 1 January 2023, the exemption method was also applied to foreign directors’ remuneration. This rule no longer applies, so that for the €50,000 of emoluments as a Belgian director, Bart can only offset the Belgian tax already paid in his Dutch personal income tax return (in accordance with the so-called offset method). Depending on the facts and circumstances, one of the two methods will be financially more favourable than the other.

Social security

For the sake of completeness, it is worth noting that nothing has changed with regard to social security. The rules of reference of Regulation 883/04 still apply. As a result, a difference may arise more often under the new treaty between the tax and social security treatment of remuneration for day-to-day management.

Recommendation

The above example underlines the point that under the new treaty it is even more important to make a clear distinction (preferably in writing) between remuneration for the directorship and remuneration for other activities (day-to-day management).